How to Trade in Futures and Options

Trading in F&O or Futures and Options requires specific knowledge and skills. One needs to have sharp clarity on basic concepts like fundamental analysis, technical analysis, F&O strategies, and the different put and call options.

This trading is a tad bit more complex than equity investments, so you need to understand its nuances before you begin trading. The derivatives market is one unique segment of the equity market, containing F&O or Futures and Options.

If you are just starting out and want to know how to do future and option trading, here is a guide to things you must know before trading in F&O to help make your F&O journey easier.

F&O

Unlike stocks, which can be directly traded on the stock market, derivatives are those instruments that lack a present value. They indicate the underlying asset’s price, and you can place your opinion on its future price.

Trading in derivative products like Futures and Options is like speculating on the value of pre-existing instruments (e.g., Gold, stocks, bonds).

Also Read: What is Futures and Options?

Companies | Type | Bidding Dates | |

| Regular | Closes Today | ||

| Regular | Closes Today | ||

| SME | Closes Today | ||

| SME | Closes 24 Oct | ||

| SME | Closes 24 Oct |

Futures and Options Differences

Although both are derivative products, there is a fundamental difference between Futures and Options. Futures are an obligation for both the buyer and seller, where they have to trade at a pre-established value of the underlying asset.

In contrast, Options are not obligations, but a right of the buyer, where they can trade at a pre-established price of the underlying security.

To simplify this further, when the buyer enters into a futures contract with the seller, they forge an agreement to buy and sell the asset respectively at a specified time in the future at a particular price. Thus, the buyer has an obligation to buy the assets as per the agreement. It can be thought of as a commitment that must be fulfilled and squared off at the specified date.

With an options contract, the buyer agrees to buy the asset only at a fixed price, but is not obligated to do so. It is an option buyer’s right to exercise or not exercise the contract.

For instance, if any transportation company wants to avoid bearing an unexpected fuel price rise, they can buy futures contracts. A seller can sell these contracts to protect themselves against an unexpected fuel price fall. Here these parties are hedgers or real companies, and fuel is their business base. They agree on the price and quantity of fuel and delivery date.

Before we dive deep into how to trade in f&o and understand how the F&O process works, let’s understand some of the commonly used terms in in the derivatives market:

- Call Option: The call option gives the buyer the right to buy an underlying asset at a specific price on or before the expiration date

- Put Option: The put option gives the buyer the right to sell an underlying asset at a specific price on or before the expiration date

- Spot: The spot price is the current or present price of the asset in the market

- Strike: The strike price is the price at which the buyer and the seller decide to buy or sell the asset after a particular time period

- Option Expiry: The day of the expiration of the Options contract which is the last Thursday of each month

- Option Premium: A non-refundable premium paid by the Options buyer to the Options seller

How to Trade in F&O

To begin trading in F&O, you can follow the following process.

Step 1: The primary step to begin trading and understanding how to trade in futures and options is to create a trading account with a broker where you can buy and sell Futures & Options contracts. These contracts are bought via BSE or NSE registered broking firms.

Step 2: Once your account is created, you have to log on to the portal. You can also choose the mobile application option and browse through the various F&O options available.

Step 3: After picking a platform do some research on which futures and options are available and what suits you better.

Step 4: After finalising your choice, put in the order details, and now you can buy the futures and options at the strike price. It is the price at which a call (option contract owner buys the underlying security at this price) or put option (option contract owner sells the underlying security at this price) is exercised.

You buy a Call Option or sell a Put Option if you predict the prices to rise, and vice versa if you predict the price to go down.

Step 5: A vital factor that helped negotiate the Futures contract’s price is the spot price. Any asset, like currency or commodity, has a current market price. This is the spot price, which helps in the immediate buy or sell of the commodity, and is the base indicator for the Future contract’s pricing.

Now that you have bought an Options contract, there are three outcomes to it to help you take the next step.

- Offset the Position: Offsetting the position is when the options contract is sold to close the position before the expiry. The result of this selling may result in profit or loss for the seller depending on the price at which the underlying asset is sold.

- Exercise the Position: The call options contract can be exercised when the underlying asset’s price is above the strike price. In a put option, the same can be done when the underlying asset’s price is below the strike price.

- The Contract Expires Worthless: The options contract expires worthless in a call option when the underlying asset’s price expires below the strike price. In a put option, this happens when the underlying asset’s price expires above the strike price.

What is Expiry in Futures Contract?

The Indian stock exchange has provided a fixed expiry date for F&O contracts. You aren’t bound for contract fulfilment for the Options contract, and it will expire after the fixed date. However, for the Futures contracts, you are bound for contract fulfilment on the expiration date. The last working Thursday of a month is the expiration date for both Futures and Options.

So, the final step is to fulfil the terms of the contracts.

How to Trade F&O on Groww

Here’s how you can begin trading in F&O:

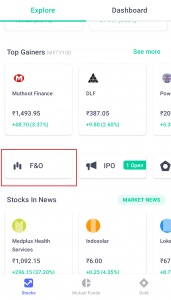

Step 1: Login to your account on Groww.

Step 2: Click on ‘F&O’ from the list of options available below the ‘top gainers’.

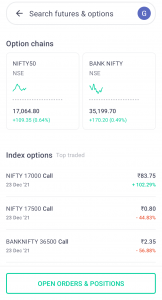

Step 3: Now you will be able to see ‘Option chains’ – which will take you to all the available contracts.

Futures and options contracts include contracts such as index options, stocks options, index future and stock futures as well.

Step 4: Choose as per your preference. In this tutorial, we have selected the Nifty 50 option chain.

Step 5: Once you click on Nifty 50, you should be able to see all the available contracts with their strike price, call price and put price.

You can similarly access this data for any other security or index by typing its name in the search option above.

Step 6: Click on your preferred call option and a screen like the one below will open up:

Step 7: Scroll down for more information like Market Depth which displays buy orders and sell orders and so on. You will also see the options of ‘Buy’ and ‘Sell’ which will allow you to make your F&O order.

Note: You can also access F&O by directly clicking on the stocks or index from the login screen. Here’s how:

Step 1: Login to your Groww account.

Step 2: Click on the contracts you want to see on the search bar. (For example, Nifty 50)

Step 3: Click on ‘View Option Chain’ and you will be able to see the call price, strike price, put price and other related information on your screen.

Things to Keep in Mind

Now that you are aware of the F&O trading process, here are a few things to be mindful of:

- Options contracts have a risk limitation to your premium amount, but on the flip side, money-making is also limited.

- Future margins have a rising tendency when the market is volatile. Margins in Future is the money you need to deposit with the broker on buying a Futures contract. If the margins rise up sharply, you have to put in fresh margins, failing which your broker has to cut down your Futures position.

- Profit target and stop losses are also important in Futures. Stop losses are advance orders of asset-sell at a particular point, which helps you to limit your loss. The importance of profit targets is huge because your trade exit point determines the profit you make.

- While trading in F&O, your mindset should be of a trader. Protection of primary capital can be your focus, for which you need to define your profit trade-off and loss for every trade.

- You must check the costs you are bearing in the F&O trade. For FnO trading, you will incur brokerage costs, statutory charges, stamp duty, and likewise charges.

The Bottom Line

To begin, F&O trading may come across as a challenge for most people entering the stock market. But, understanding how to trade in Futures and Contracts is not rocket science. The process becomes easier to deal with when you understand the relevant terms and strategies.

Below are some educational videos that will help you understand better.

- Technical analysis of stocks

- Predicting direction of movement: Double top & double bottom pattern

- Identifying overbought or oversold: Bollinger band indicator

- Understand breakouts: Moving average indicator

Check Other Options: