New Feature Alert - Safe Exit on Groww

Profits and losses are part and parcel of trading in Futures and Options. We all know that intraday trading in F&O carries a substantial risk wherein a good chunk of day traders encounter losses every day. Many such traders attempt varied measures to recover their losses, often resulting in further losses.

But what if you get to avail of a feature that helps you limit your F&O losses for the day?

Well, you can do so now on Groww with our latest feature - ‘Safe Exit’ !

What is ‘Safe Exit’ Feature on Groww

Safe Exit is a newly launched feature on Groww, especially built for F&O traders. It is a risk-management solution that automatically triggers orders to close open positions in futures and options when the total losses for the day reach a level a trader has set.

This feature allows you to exit all F&O positions if you hit your loss trigger price.

Companies | Type | Bidding Dates | |

| Regular | Closes Today | ||

| Regular | Closes Today | ||

| SME | Closes Today | ||

| SME | Closes 24 Oct | ||

| SME | Closes 24 Oct |

How Does ‘Safe Exit’ Help You in F&O Trading ?

The key objective of introducing this new feature is to provide day traders with the opportunity to control their day-to-day losses and overcome any consequences that may affect their future trading activities in the long run.

How to Set Safe Exit on Groww?

Here, we have outlined the necessary steps to set a Safe Exit on the application-

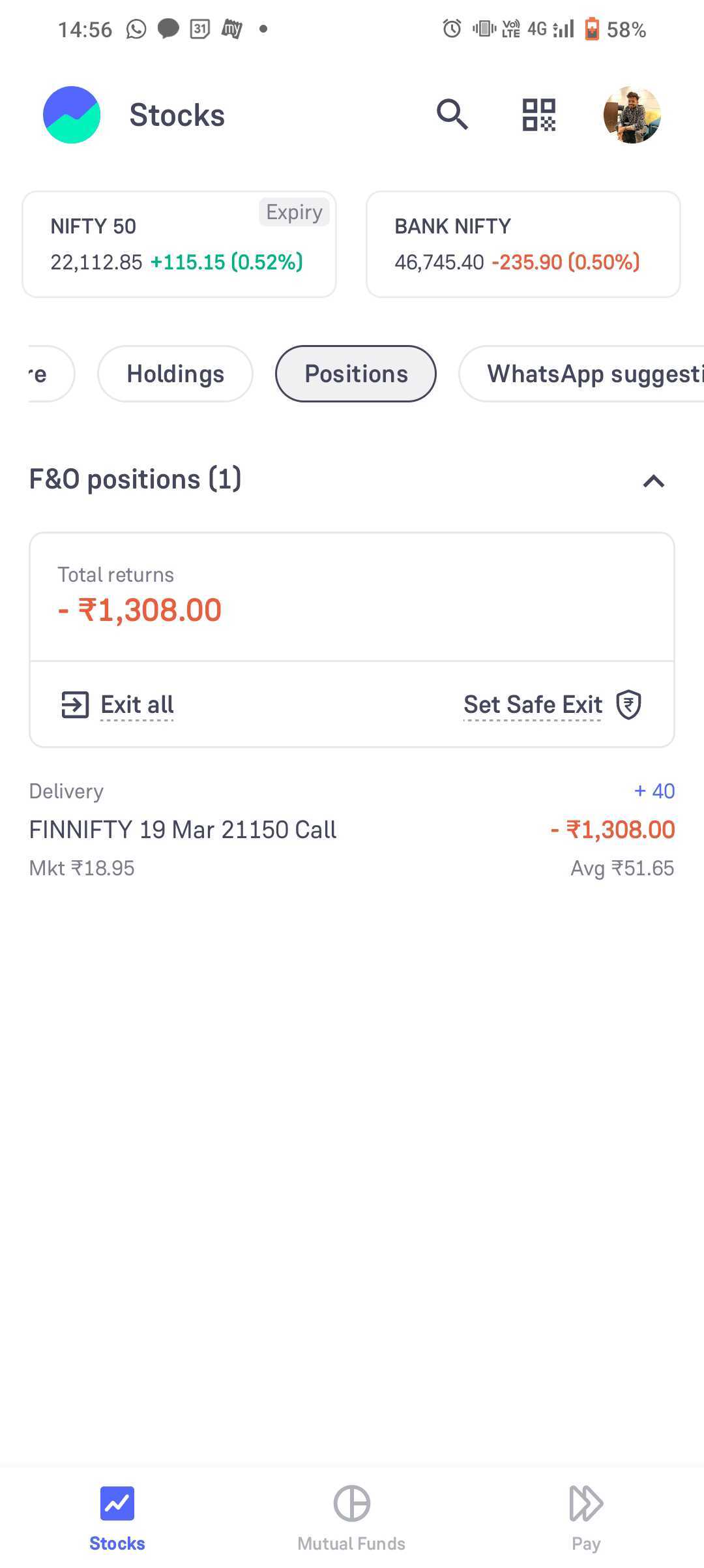

Step 1: Click on the ‘Positions’ tab. Here, you can view the ‘Set Safe Exit’ option and set up the preferred trigger level.

Step 2: Click on the ‘Set Safe Exit’ option and then on ‘Continue’.

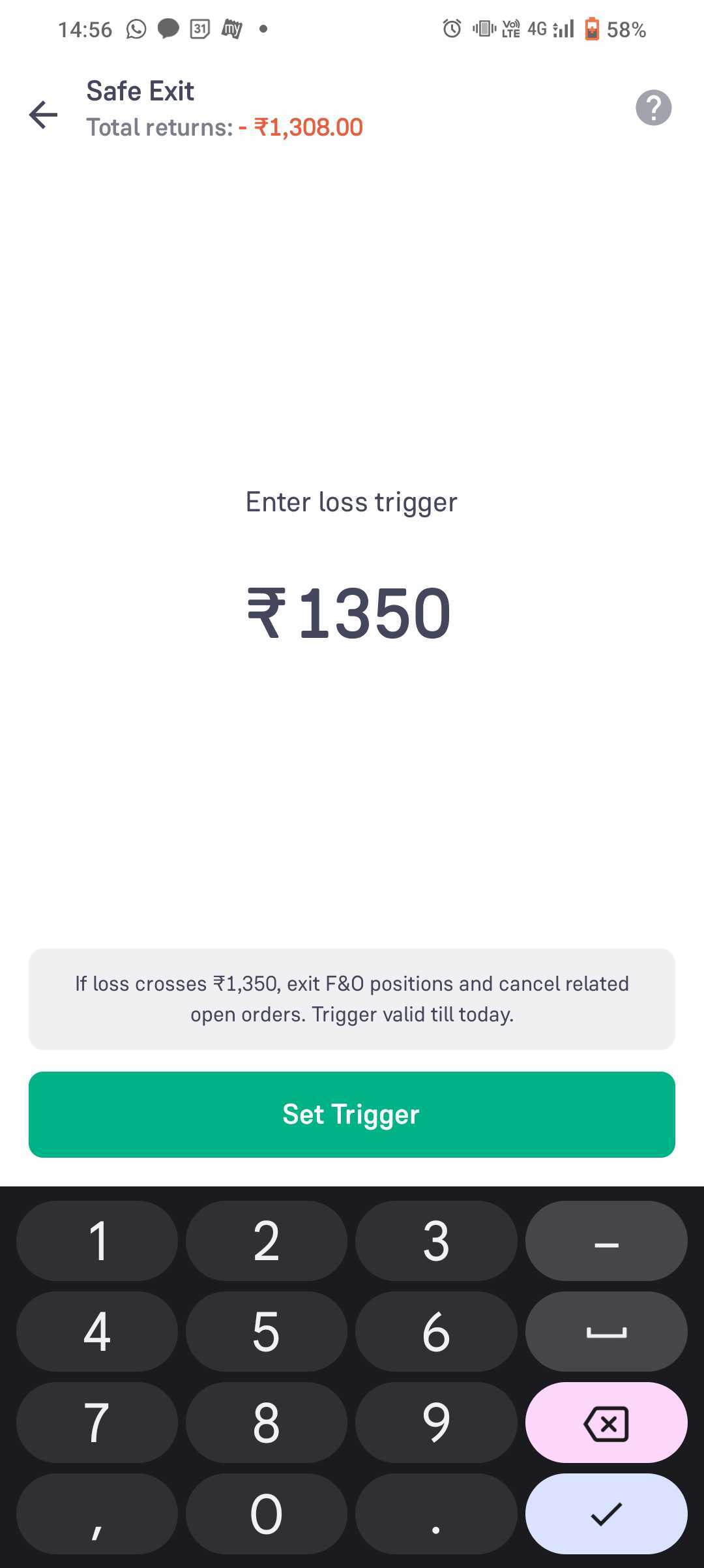

Step 3: On the next screen, you have to simply enter the ‘Loss Trigger’ at which you intend to trigger the order to close your positions.

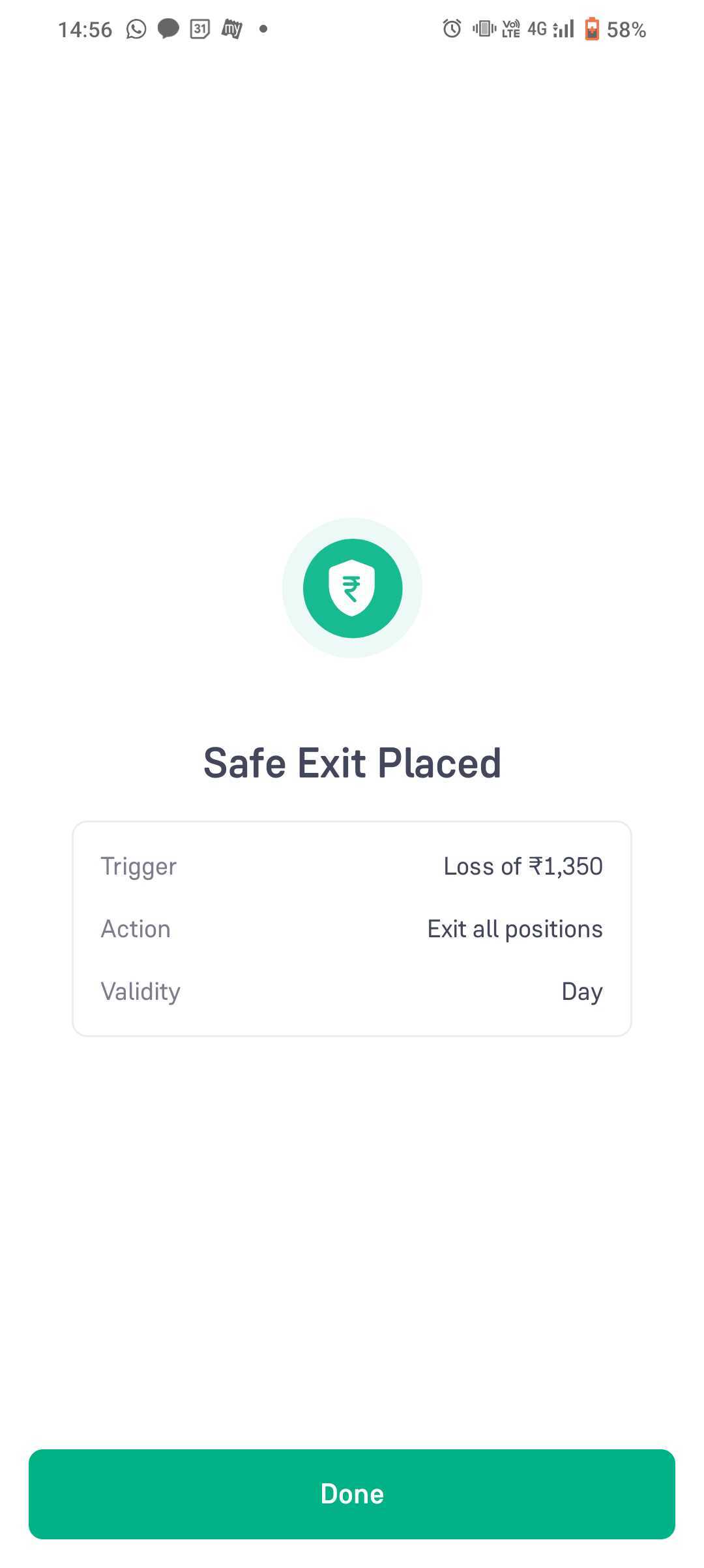

Step 4: Click on ‘Set Trigger’. Once done, a screen will appear, stating ‘Safe Exit Placed’. Here, you can view your Trigger, Action, and Validity period. Click ‘Done’ to complete the process.

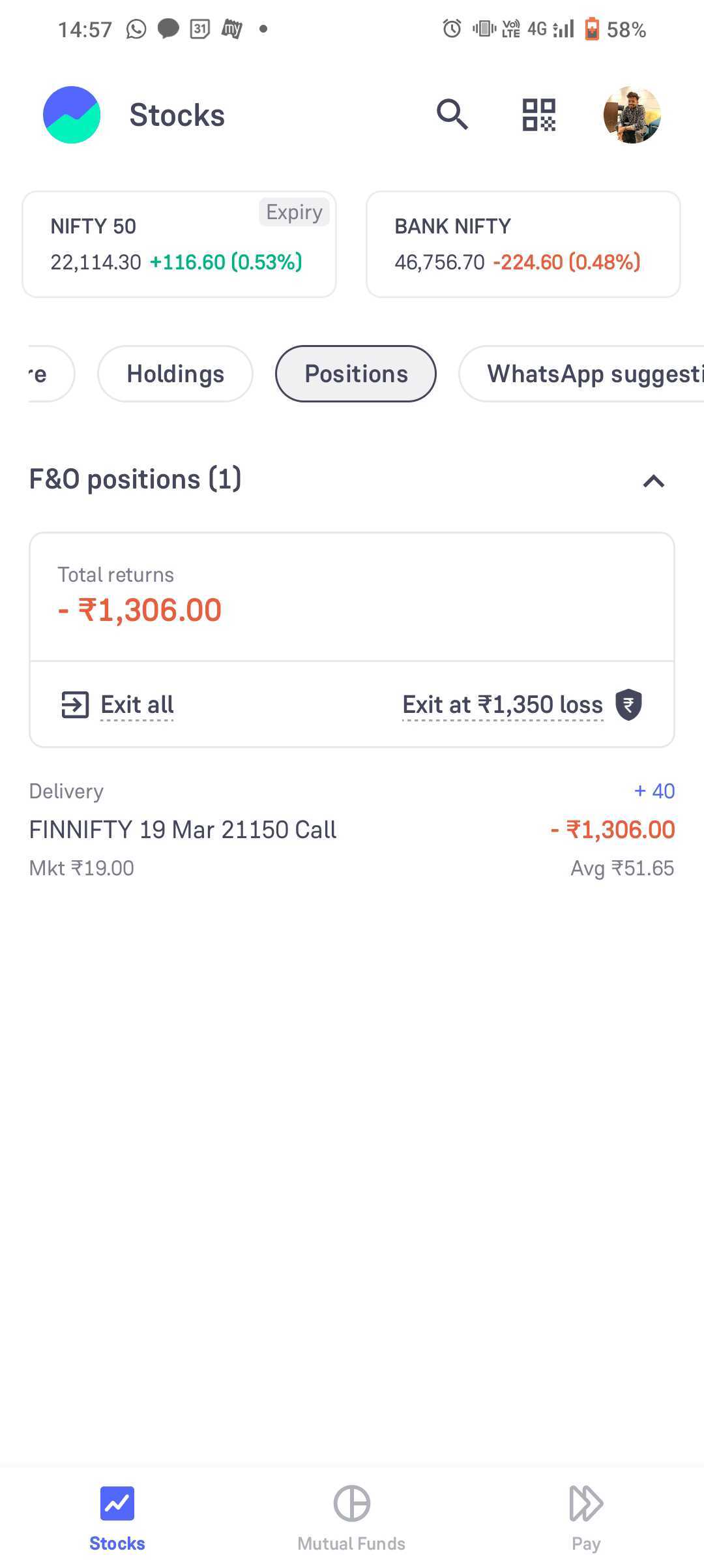

Step 5: Once you have set your loss trigger level, you will be taken back to the ‘Positions’ tab, where you can view the total returns and ‘Exit at ₹ ___’ amount.

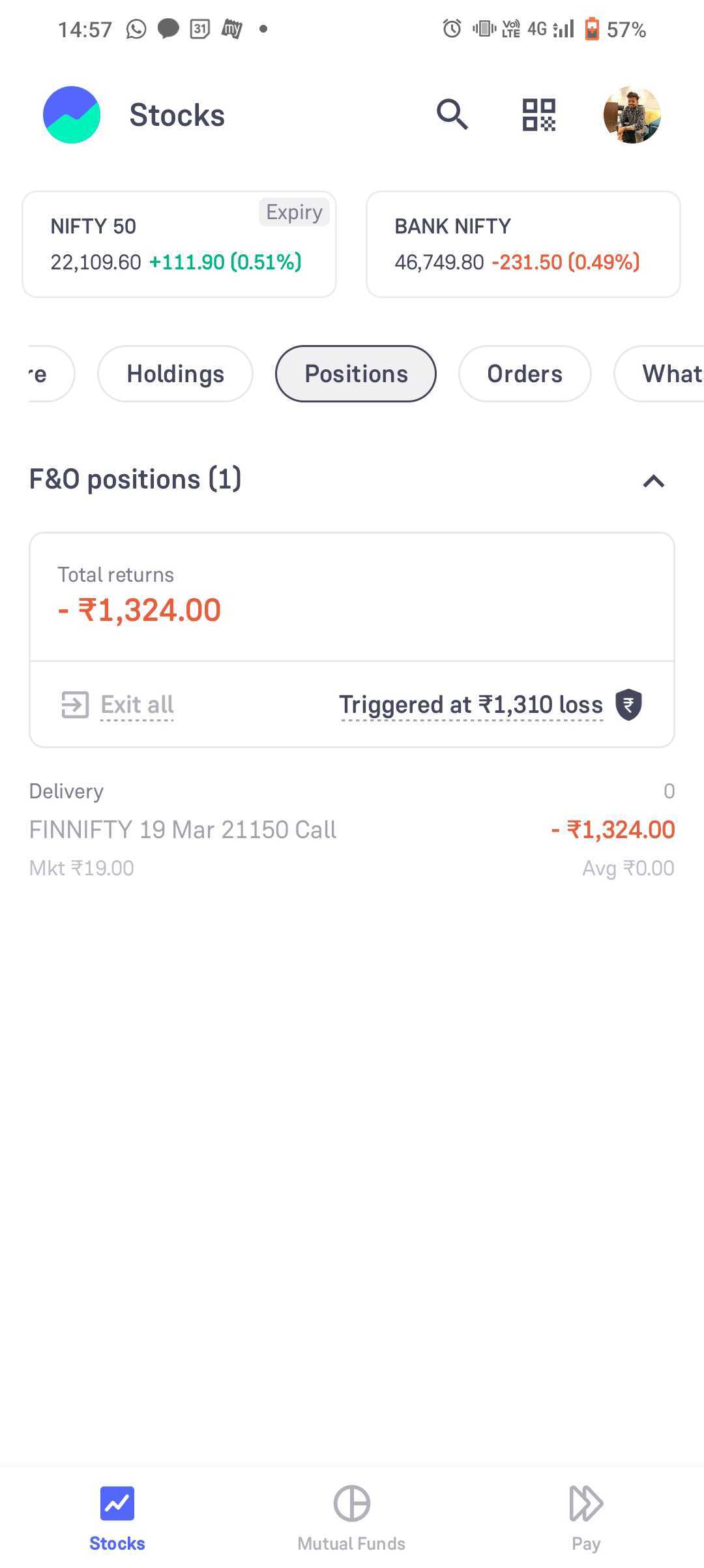

Step 6: Once the day's exit limit has been reached, the orders to close your open positions will be automatically triggered. A screen will be displayed stating, 'Safe Exit Triggered at ₹ ___ loss. '

Note, before closing your open positions, we will cancel all the open orders against your open positions, except for specific order types such as GTT (Good Till Triggered) and OCO (One Cancels the Other).

|

Remember, your total returns are likely to change from the set trigger, as your position will get squared off at the best available market price. |

Step 7: Click on the ‘Order’ tab to view all the orders and respective details.

Why Should You Use ‘Safe Exit’

- Effective Loss Management: With this feature, you can effectively manage your positions and combat losses as it automatically closes positions when set exit levels are reached.

- Overcome Uncertainty: ‘Safe Exit’ can prove to be very useful as it reduces your risk of encountering unexpected losses.

Points to Remember

- The feature is built explicitly for futures and options trading on Groww.

- You can easily modify or cancel the ‘Safe Exit’ feature once it is activated, at any time, through the ‘Position’ tab.

- Groww does not charge additional fees to use or access the ‘Safe Exit’ feature. However, standard brokerage fees may apply as per your square-off orders for open positions.

- Setting your trigger level cautiously is essential, as it will determine when your positions will be closed. Note that the total returns may vary as we trigger the order at that limit. The orders are placed as market orders and can be executed at whatever price is available at the stock exchange.

- If you exit all your positions yourself, the Safe Exit will still be active if you enter a new position.

- If the ‘Safe Exit’ does not trigger on the day you set it, it will be reset the next morning.

- The ‘Validity Period’ here means that you have set the safe exit, and if it's not triggered during the day, then the safe exit will expire after market hours, irrespective of whether you have an open position or not.