EPF Balance

Employee Provident Fund (EPF) is a fund in which a portion of your salary gets deposited every month for the purpose of building your retirement savings.

What is EPF Balance?

EPF balance is the total amount of your salary that is deposited in the EPF account, under your name, on a particular date. Each month a fraction of your salary is deposited into this retirement savings fund.

How to Check EPF Balance?

Following are the ways to check the EPF Balance-

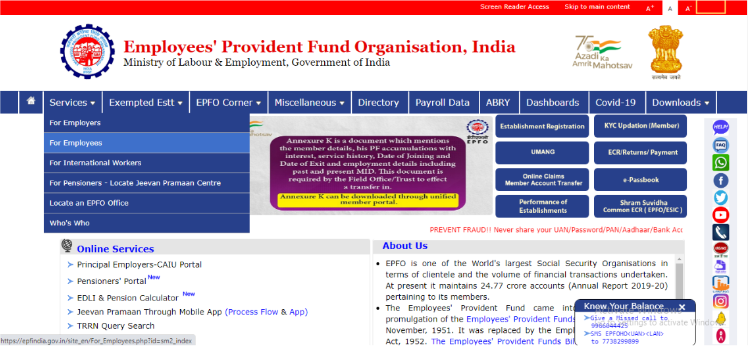

1) Find EPF Balance Through EPFO Portal/UAN Number

You can check your balance on the EPF India website. UAN (Universal Account Number) helps you access your entire balance under one single window). It can easily be checked on the EPFO’s member portal.

The steps you need to follow for the same are:

- Visit the EPFO’s member portal – https://www.epfindia.gov.in/site_en/index.php

- Select the ‘Know your balance’ option, which is available at the bottom of the screen

- Subsequently, you will need to select the location of your regional EPF office

- Next, you can enter your PF account number and your mobile number

- That’s it, you’re done, it’s that simple.

Alternatively, you can also check your balance via UAN. Here's how to do the PF balance check with UAN number-

- Visit http://uanmembers.epfoservices.in/

- Thereafter, enter your UAN number and password.

- Subsequently, you are required to select your EPF state and city

- Next, you will receive an SMS about your EPF balance

2) Check EPF Balance Through UMANG App

Unified Mobile Application for New-age Governance (UMANG) app can be used to check the EPF balance in no time. It can be easily installed and used on a smartphone to check the balance.

Along with checking the EPF balance, you can raise and track claims over the app.

To access, a one-time registration will be required to be done by using the member’s registered mobile number to get access to the application.

Now you would want to know how to check PF balance online through the UMANG application with a detailed procedure. So here are the steps to view the chronological EPF transactions via the UMANG app-

Step 1: After installing the app, click the EPFO option.

Step 2: Choose the “Employee Centric Services” option.

Step 3: Next, click on “View Passbook”. Provide your UAN and fill in the One-Time Password (OTP) that will be sent to the registered mobile number.

Step 4: Click on ‘Login’, and all the EPF transactions, deposits and withdrawals from your current and previous employment will be visible.

3) EPF Balance Check on Mobile Number

EPF balance can be checked through the PF missed call number. Simply give a missed call on 9966044425 from the registered mobile number to check the balance.

Note that an employee’s Aadhaar Card, PAN, and bank account number must be certainly linked with the UAN.

4) EPF Balance Enquiry with Unregistered Mobile Number

You can easily check your balance without any registered mobile number with the following steps-

- Go to the official website of PF Passbook Portal.

- Log in with your UAN and password.

- Select the PF account for the EPF passbook balance check.

- Click on “View PF Passbook Old”.

- The total employee balance and employer balance in your PF account will be displayed on the screen. You can also check the pension balance in the last column of the EPF member passbook.

5) EPF Balance Check Through SMS Service

If employees have activated their UAN, they can do the balance check on mobile number sms online by sending an SMS to 7738299899.

The format is SMS - EPFOHO UAN ENG. Note the last three letters are the preferred language in which the employee would like to obtain the details.

This facility is available in Marathi, Bengali, Kannada, Malayalam, Hindi, Tamil, Telugu, Gujarati, Punjabi, and English. Also, for availing of these services, the Aadhaar, PAN, and bank details of the employee are required to be linked to the UAN.

EPF Deductions

The amount in your EPF balance will be determined on the basis of what percentage of your salary is deducted each month.

Under the Provident Fund scheme, the employer, as well as the employee, contribute 12% of the employee’s basic salary (plus dearness allowances, if any) into the employee’s EPF account.

The full 12% of the employee’s contribution goes into his/her EPF account. Additionally, 3.67% (out of 12%) of the employer’s contribution also goes into your EPF.

The remaining 8.33% of your employer’s contribution is credited to your EPS (Employee’s Pension Scheme). It is important to note that EPS is different from EPF.

What is the Tax Structure on EPF Balance?

The employer contribution to the EPF is tax-free. As far as the employee’s contribution to EPF is concerned, the employee can take the benefit of tax deduction under Section 80C of the Income Tax Act.

Simply put, for the employee, investment in EPF, the interest earned on the EPF balance, and the money withdrawn after the mandatory specified period (5 years) are all absolutely tax-free.