How To Start A STP And SWP On Groww

Systematic Transfer Plan (STP) and Systematic Withdrawal Plan ( SWP) are facilities available for our mutual fund investments. STP allows us to transfer money from one mutual fund to another in a regular periodic fashion, SWP allows us to withdraw or redeem our mutual fund investments in a periodic fashion. SWP is a way to get regular income from your mutual fund investments.

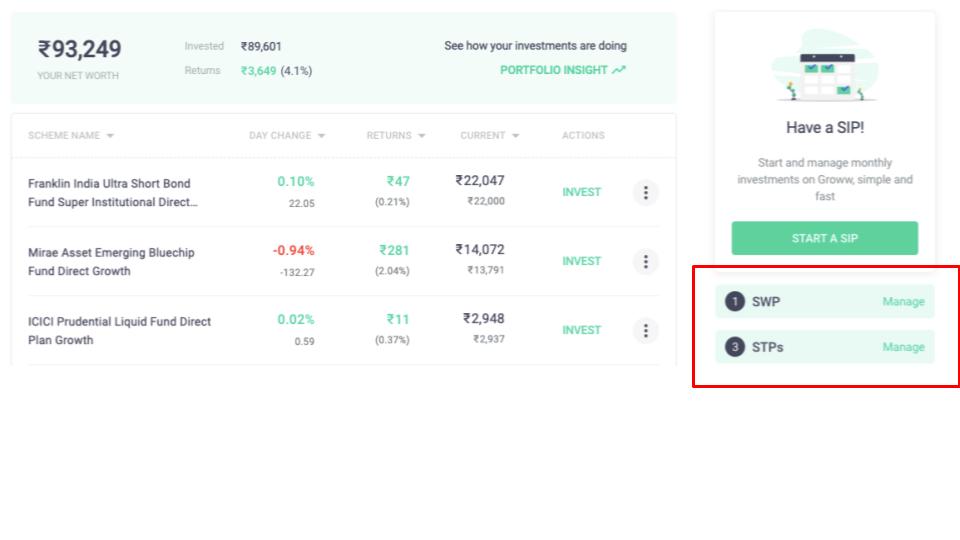

Currently, these facilities are available on the website only.

How To Start STP On Groww?

While you must be aware by now what a SIP stands for, a STP is still a lesser-known feature of mutual funds, yet something every investor must know of. STP is a tool for the systematic transfer of money between mutual funds. STP allows you to transfer your investments from one mutual fund to another within the same AMC.

Here is how you can do an STP on Groww within minutes.

Step 1: Log on the Groww platform and click on “ Investments” on your dashboard.

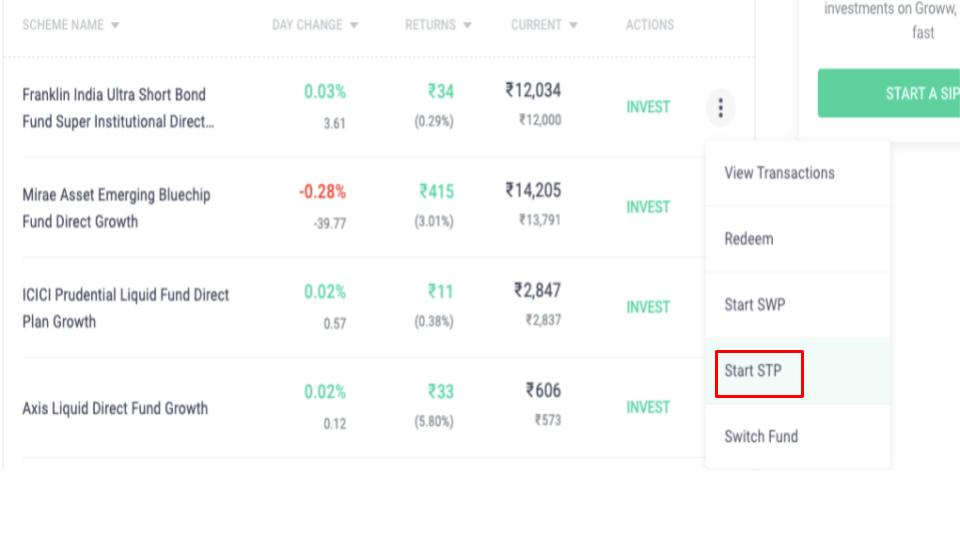

Step 2: Select the source fund from which you want to transfer your money to the destination fund. You can do this by clicking on the three dots and selecting ” Start STP” from the drop-down list. Remember, the destination fund must belong to the same asset management company as the source fund and hence you need to choose wisely.

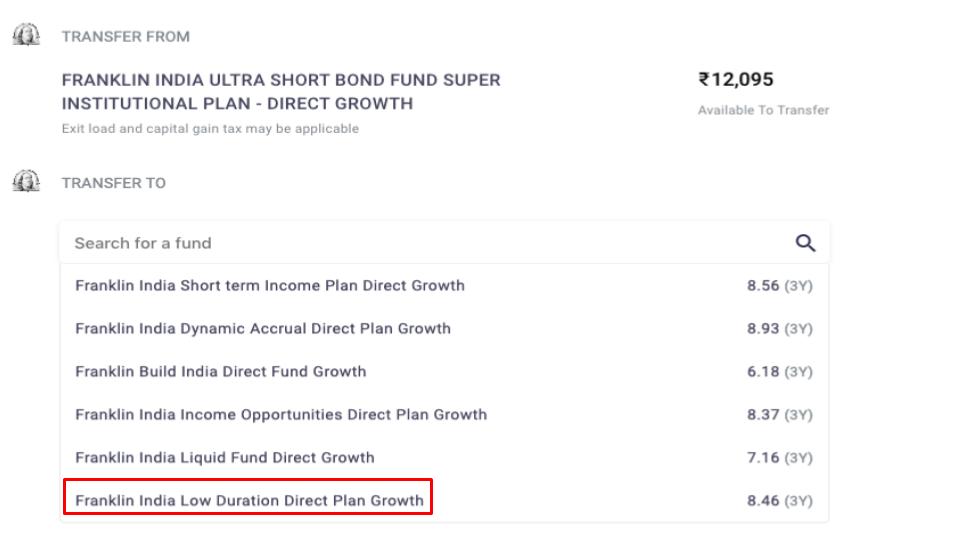

Step 3: Once you have selected the source fund ( from where your funds will be transferred), the next step is to select the destination fund.

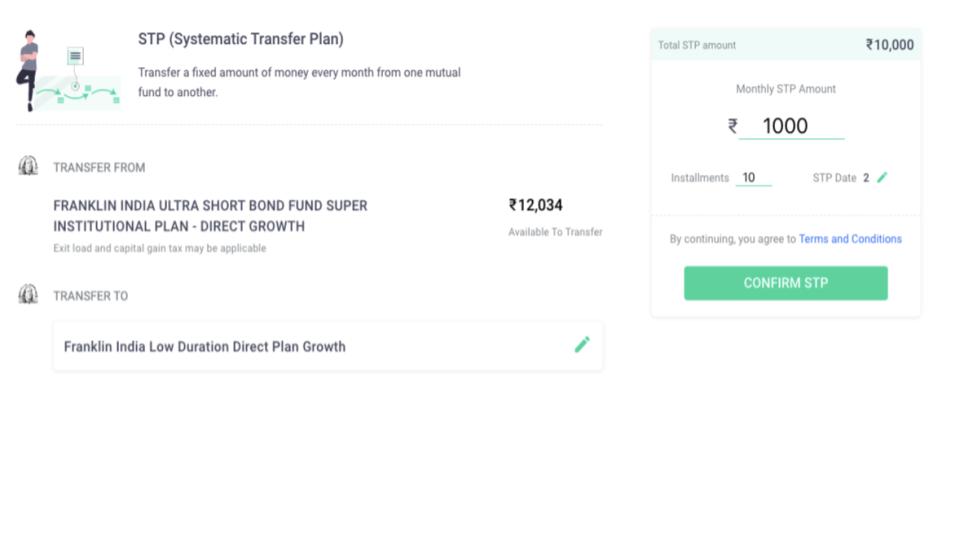

Step 4: Based on the monthly transfer amount you enter, the number of installments is calculated, after removing units from lock-in from the source fund. You can select the date from which you want the STP to start. Once you are sure of the source and destination fund, click on ” Confirm STP ” to proceed and your process is completed. You can go back to the dashboard to manage multiple STPs.

How To Start SWP On Groww?

A systematic withdrawal plan allows you to methodically withdraw money ( redeemed units) from your investment corpus. Similar to SIP, in an SWP, the amount and the time interval of withdrawal is decided by the investor. The predetermined amount is then automatically debited to the chosen account of the investor. Simply put, If SIP is about investment, SWP lets you redeem at your preferred speed.

For retirees, this will provide a steady income to meet their needs, without worrying about using up all of their money. For salaried individuals, this might be the extra push needed to make ends meet. Let us see how you can start a SWP on Groww. The process is largely similar to that of STP.

Step 1: Log on the Groww platform and click on “ Investments” on your dashboard.

Step 2: From the list of your funds, select the mutual fund you want to withdraw money from, the units of this fund will be redeemed and the money will be transferred to your linked bank account. After you zero in on the fund, click on the “3 dots” under the Action tab and select ” Start SWP”

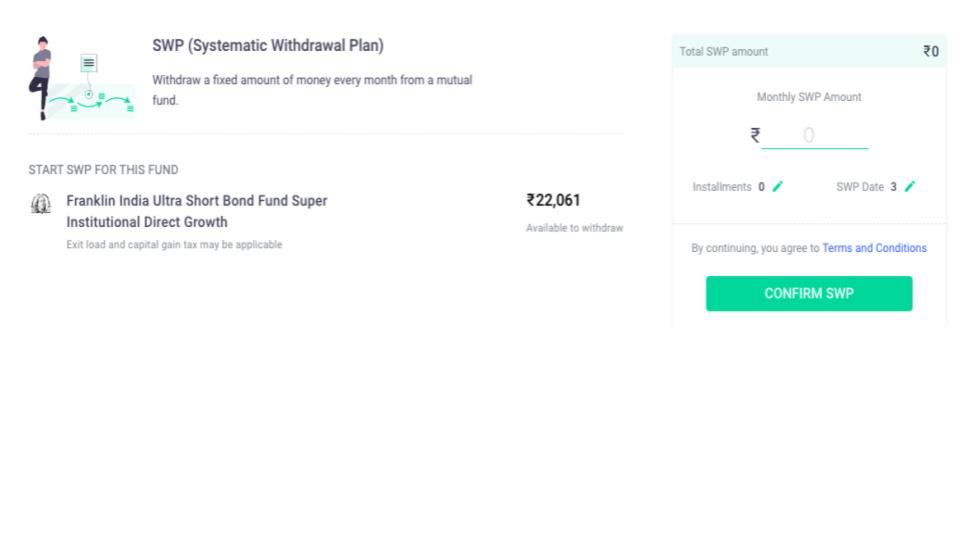

Step 3. Based on the total amount available in the fund, select the monthly withdrawal amount. Based on this amount, you will be told how many times you can withdraw from your fund. You can then make changes in the monthly withdrawal amount. Select the monthly billing date and click on ” Confirm SWP”.

This will initiate your SWP. You can easily see and manage your active STPs and SWPs on your dashboard and take action accordingly.

How Does This Benefit You?

It depends on your goals and requirements. SWP is seen as a source of regular income from mutual fund investments and is a benefit for those who require such income.

Read More on Groww: Systematic Withdrawal Plan

Just like SIP, STP also helps investors take benefit of the ‘rupee cost averaging’ feature. Investing in regular intervals in a mutual fund for a longer time helps even out the cost of fluctuations in the rupee and the markets. While high markets improve the value of units, falling markets help gather a higher number of units.

Read More on Groww: STP – Systematic Transfer Plan