How to Buy Stocks Online?

The prospect of investing in stocks may seem daunting to someone who has only read about it in the newspapers, heard it from friends, or watched it in films and TV shows.

Despite that, every year, lakhs of individuals open their first DEMAT and trading accounts to start investing in stocks.

It’s because only a few other securities may compare to the level of returns that equity shares offer. Further, online trading has made matters straightforward beyond measure. Here’s all you need to know in order to buy stocks online.

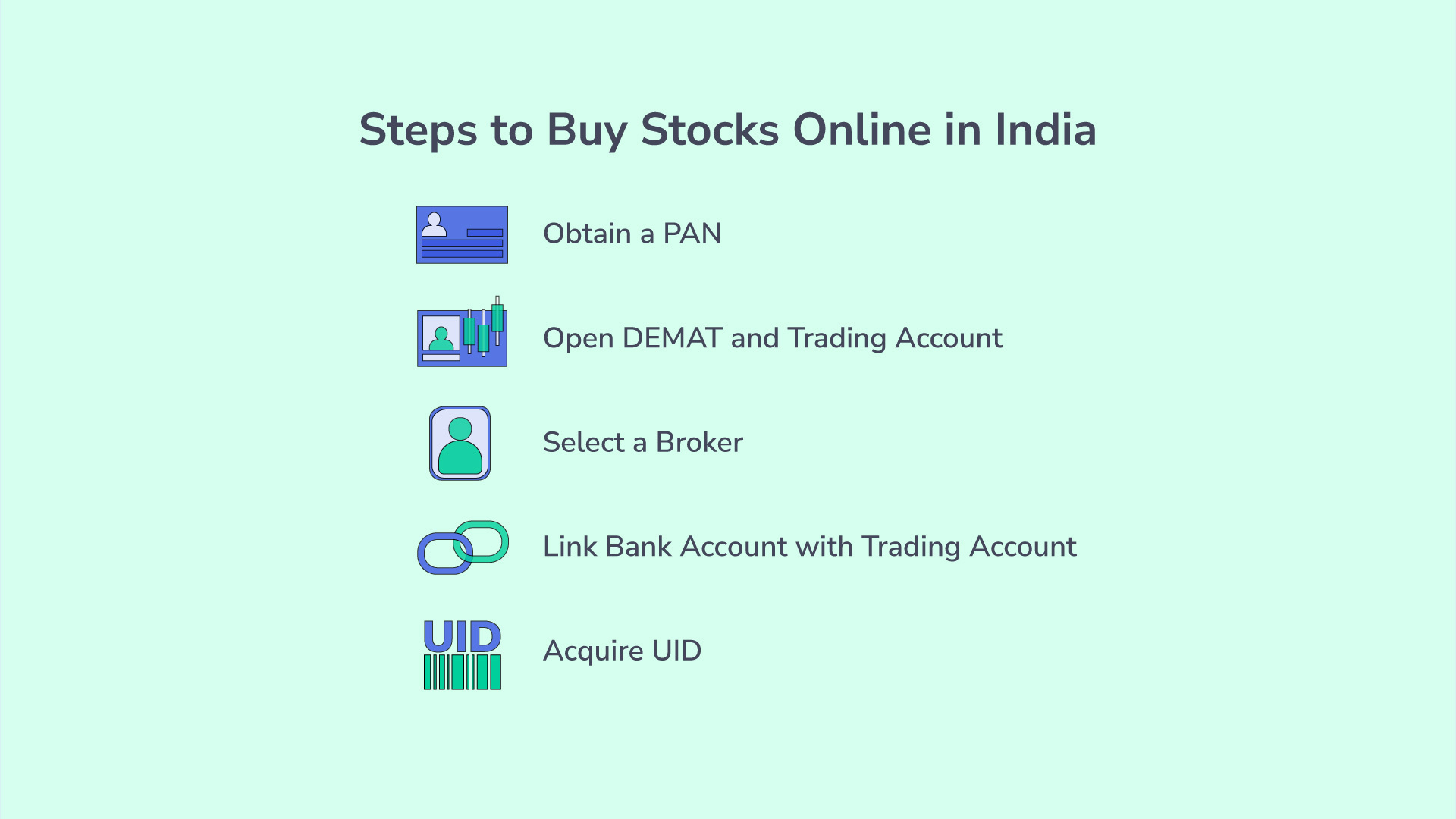

Steps to Buy Stocks Online in India

If you are wondering how and where to buy shares online in India, here are the required steps-

1. Obtain a PAN

You would not be able to buy shares online if you do not have a PAN.

As per government mandate, every individual needs to furnish his/her PAN to execute financial transactions in India.

You may, thus, want to apply for a PAN card if you do not have one already.

During online transactions, you’d be required to quote the 10-digit alphanumeric number, after which your request would be processed.

2. Open DEMAT and Trading Account

These are the accounts you’d mandatorily require to buy stocks through online mode.

The DEMAT account allows you to hold all the securities you possess in dematerialised form, while the trading account facilitates buying and selling of stocks.

You can open DEMAT and trading accounts with online investment platforms or brokerage firms.

Ensure to store the unique DEMAT and trading account numbers, which you will need to quote when buying equity shares online.

|

▶️ You may also want to know the Steps to Open Demat Account on Groww |

3. Select a Broker

One of the first things to know when considering how to buy stocks online is you cannot trade shares directly. You can only invest in stocks through SEBI-registered brokers and investment platforms.

These intermediaries levy a brokerage charge to facilitate this service. It is either a flat fee or a percentage of the total transaction value.

You may want to assess your investment objectives in conjunction with the cost levied by different brokers to determine the best alternative.

Also, consider the range of securities alongside stocks a broker offers before registering with them.

4. Link Bank Account with Trading Account

All your transactions will be performed via the trading account. However, when it comes to how to buy shares, your bank account is also necessary.

You place an order to buy stocks through the trading account, but the payment for it is processed via your bank account.

Hence, it’s advisable to link all three accounts – DEMAT, trading, and savings – to ensure seamless order executions. Better still, you can look for investment platforms that offer a Demat cum trading account.

5. Acquire UID

You will need to acquire a Unique Identification Number or UID if your transaction values exceed Rs. 1 lakh. SEBI mandates this for all market participants, including investors.

Once you have seen all the necessary steps mentioned above, you can start to buy stocks via online mediums.

All you will need to do is place the order with your broker. The broker will forward the purchase order to the respective stock exchange, where it will be matched with a sale order.

Once the transaction is complete, you will receive the equivalent stock units in your DEMAT account.

Companies | Type | Bidding Dates | |

| Regular | Closes Today | ||

| Regular | Closes Today | ||

| SME | Closes Today | ||

| SME | Closes 24 Oct | ||

| SME | Closes 24 Oct |

Factors to Consider to Buy Stocks Online

There are a few factors you may want to take into account when considering how to buy shares online in India. These are–

-

Company Details

Financial experts strongly recommend investors research a company before deciding to purchase its stocks. It goes a long way in ensuring a well-informed decision.

Learn what the company does, know about the industry in which it operates, review its historical performance, check whether it’s currently profitable or not and how long its good run can sustain according to experts.

You may evaluate other aspects of the company that you think are relevant to returns as well. Some investment platforms feature detailed reports on companies that can be significantly beneficial to that end.

Besides a sound decision, this research will ensure you have an edge over other novice investors.

-

Beta

A stock’s beta refers to the degree of volatility it demonstrates in relation to the overall market index. It may be wise to check the beta of a stock before you decide to buy it.

Any beta value over 1 signifies a more volatile price movement in regard to the underlying index. For instance, if a stock has a beta value of 1.2, it represents that a 100% change in the index will result in a 120% increase or decrease in its price.

Hence, any stock with a beta above 1 is of high risk. Conversely, an equity share having a low beta value is of low risk.

-

P/E Ratio

It denotes the relationship between a company’s current share price and earnings per share. The P/E ratio helps investors determine the value of stocks.

If a stock you are planning to buy features a P/E ratio of 30%, it signifies investors’ intent to pay Rs. 30 to earn Re. 1 of the company’s earnings.

There’s no good or bad P/E ratio, and it depends on the industry. Thus, compare P/E ratios of similar companies and also the rate at which the P/E ratios are growing before you buy stocks on an online platform.

-

Dividend Payouts

Analysing dividend payouts can signal a company’s financial health and growth stage.

Organisations that pay dividends inconsistently are often in their growing stages. These companies are poised to offer excellent capital gains to their investors.

On the other hand, it indicates a well-established financial footing and steady cash flow when the enterprise pays regular dividends.

Conclusion

However, the factors mentioned in this blog are merely assumptions based on popular trends and not tenets set in stone. It’s wise not to interpret a company’s potential based on only one factor. Consider utilising several metrics and relevant factors in conjunction to reach a well-rounded conclusion.

Doing so will position you better when you buy stocks online and allow you to invest successfully by optimising profitability.

Happy investing!

|

You May Also Be Interested to Know- |

|

|

1. |

|

|

2. |

|

|

3. |

How are Stock Prices Determined? |

|

4. |

|

|

5. |

|

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.