How do I Transfer Shares from Another Demat Account to Groww Demat?

Greetings investors! Hope you have checked out the Groww stocks platform and have opened your account already. Wouldn’t it be great if you had all your holdings at one place for an easy trading experience? The good news is, once you have opened your Demat account at Groww, you can transfer shares from your Demat accounts with other brokers to Groww by following the off-market transfer process.

Here’s a step by step guide to help you. Read on!

Before we begin make sure you have the Client Master report which has the details of the client ID and Demat account from the broker you have a Demat account with. Also, keep the CMR you received from Groww handy.

Registration for Easiest on CDSL ( Easiest is CDSL’s internet based facility)

Step 1: Go to cdslindia.com and click on “Login to-New system Myeasi (BO/CM)".

Step 2: Click on ‘To register for easiest click here’.

Step 3: Enter your Client ID and DP ID. Please note, this client ID and DP ID is the one you have received from the external broker and not that of Groww. The first eight digits of your Demat number are the same as your DP-ID and the next eight numbers are the same as your Client ID.

Step 4: An OTP will go to your registered mobile number. Enter the OTP and click on Continue to proceed.

Step 5: Fill the necessary details and then select the account type as ‘Trusted Account (PIN) to continue

Step 6: In this screen, you need to enter your Trusted account details.Trusted means details of the broker you are transferring the shares to.So here, you are required to enter your Groww Demat account number. You can find it in the CMR copy sent to you. You can also find it on the Groww app under personal details. Your Groww Demat number is of 16 digits and starts with 120887.

Step 7: Now suppose you have holdings in multiple Demat accounts. You would have received your Demat account numbers with all these brokers at the time of account opening. So at this stage, you can enter the Demat account details of each of these brokers and click on the ‘+’ sign to add the entries. Please note you can add details of brokers who are registered with CDSL only ( upto 4 such entries are allowed).

Once you have added all the accounts from where you want your holdings transferred to Groww, click on Continue. The details you enter will be verified by the brokers ( depository participants) and post authentication you will receive a registration confirmation.

Step 8: The registration is now complete. You will now receive three emails in succession from CDSL.The first email will be a registration approval email. The second and third emails will have your login credentials – Login ID, password and PIN.

Login To CDSL Easiest

Step 1: The next step is to log in to CDSL Easiest with your username and password.

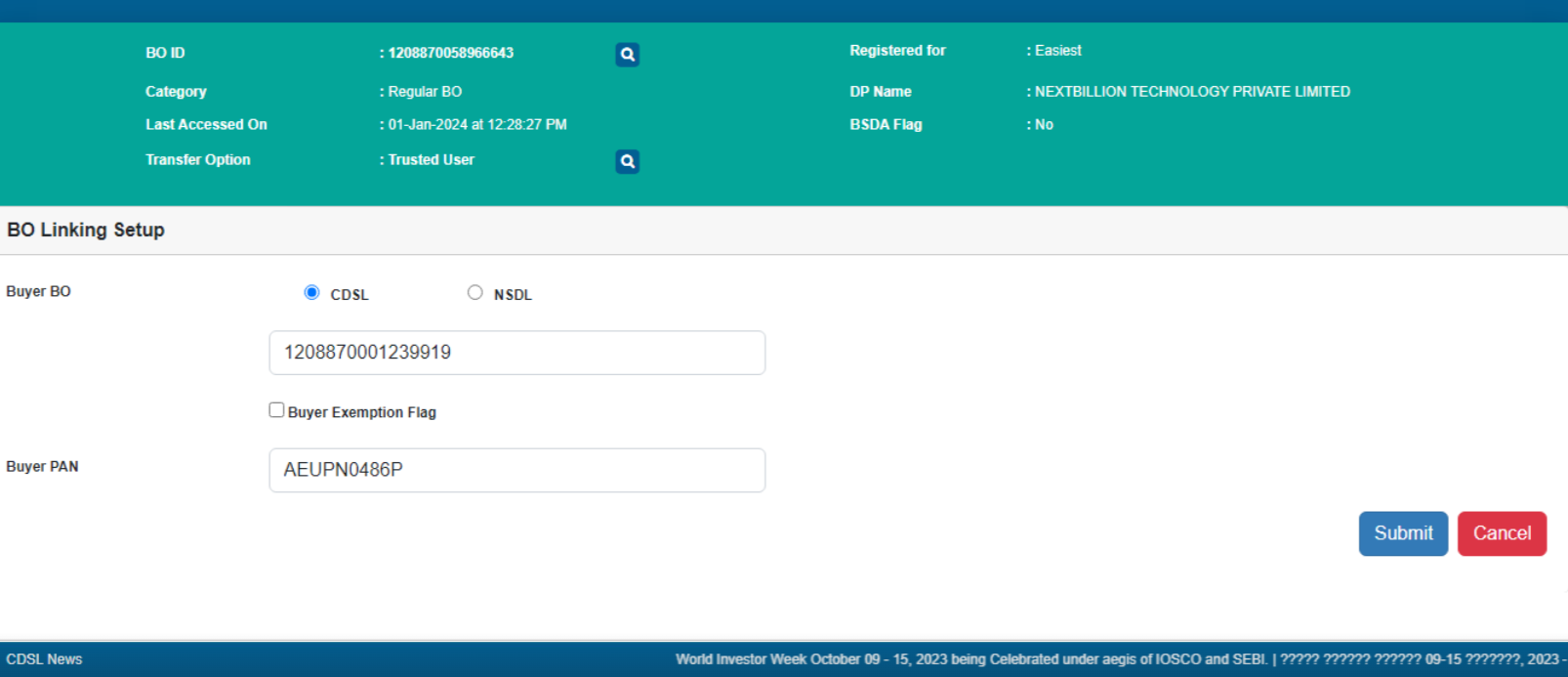

Step 2: Now enter the required information, such as Buyer BO ID and PAN details for BO Linking Setup.

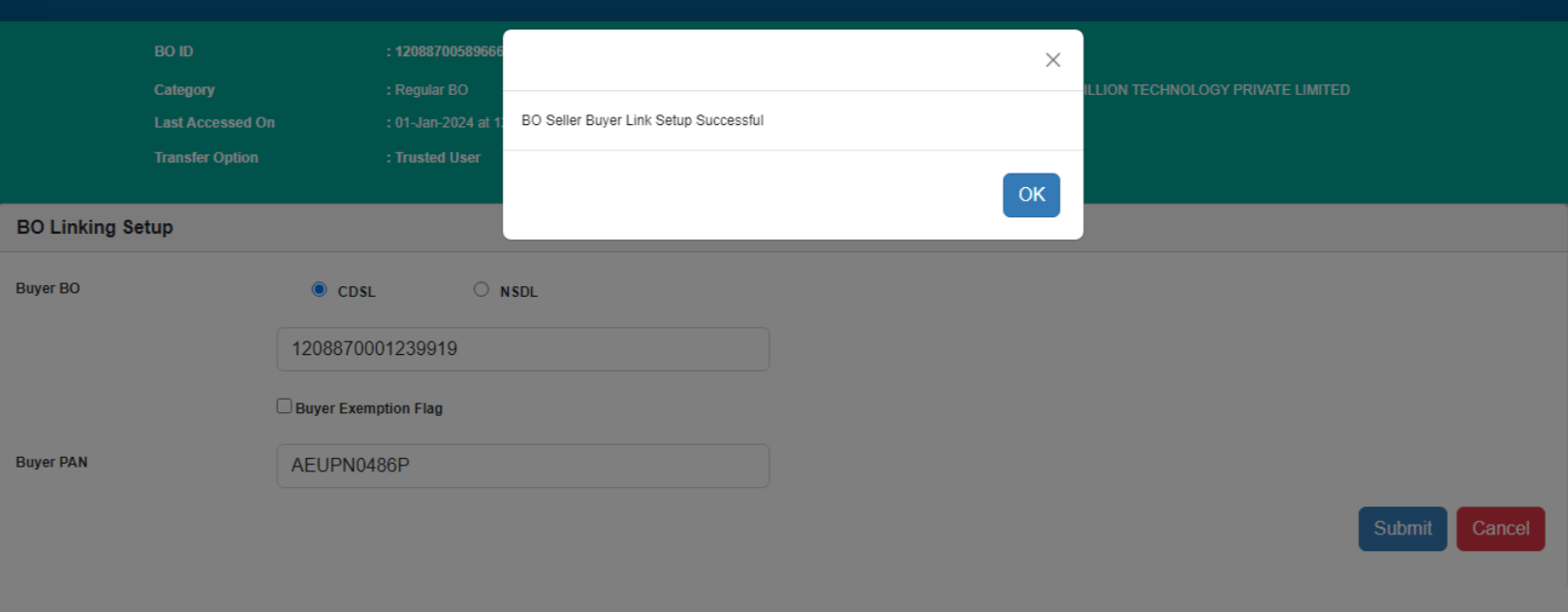

Step 3: Click the Submit button. A pop-up will be displayed on the screen once the linking setup is successful.

Step 4: After login, click on the Transaction tab and select Setup for transferring stocks through Easiest.

Step 5: Now, select the Bulk Setup option, as shown in the image below.

Step 6: Select the “+” icon to add the ISIN, quantity and the reason for transfer off-market details.

Step 7: After entering ISIN, quantity and the details about the reason, click on the SUBMIT option to continue. On verification select the option for COMMIT & enter the OTP PIN received on your registered mobile no.

Step 8: After entering OTP the Off-Market Transaction request will be completed from your end and just needs to be authenticated from Groww’s end. You will receive communication from CDSL and from our end as well once the authentication process is completed. You will be able to see your external holdings on Groww dashboard once the process is completed.

Charges for transferring your demat account

If you are transferring your shares from your demat account on Groww to another demat account with another broker, you will be charged Rs 15.93 per company. For example: if you hold 10 shares of company A, 25 shares of ‘B’ and 2 shares of ‘C’, since you have three companies in your portfolio, you will be charged: 3×15.93 which will come up to Rs 47.79.

The charge is per company and not per share.

Please note that you will have to maintain this amount in your Groww balance; otherwise, your transfer will be rejected.

Hope this was helpful. Happy Investing!

|

You may also want to know |

|

|

1. |

How to Invest in SIP |

|

2. |

How to Invest in Mutual Funds |

|

3. |

How to Open a Demat Account Online |

|

4. |

How to Invest in IPO Online |

|

5. |

How To Start A STP And SWP |

Check More Stocks

|

Shares Name |

Annual Revenue (in Cr) |

||||

|

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

687 |

630 |

655 |

864 |

954 |

|

|

-- |

-- |

6479 |

6835 |

7307 |

|

|

14402 |

13325 |

15485 |

16030 |

15294 |

|

|

-- |

32.49 |

48.42 |

52.29 |

66.03 |

|

|

4225 |

4214 |

5645 |

7373 |

4717 |

|

|

244 |

225 |

232 |

223 |

272 |

|

|

43.57 |

48.32 |

46.48 |

50.08 |

53.05 |

|

|

127 |

144 |

102 |

139 |

148 |

|

|

11563 |

10345 |

11268 |

13439 |

11329 |

|